Exploring 6% Mortgage Rates: What You Need to Know

A 6% mortgage rates means you need to consider inflation, economic health and market conditions. Fixed-rate and adjustable-rate mortgages have different benefits depending on your situation and long-term plans. 6% may sound high but it could be good in a stable economy or high inflation. Consider your risk tolerance, loan term and payment flexibility. Look at both short and long-term to see if this rate fits your financial goals and homeownership path.

What is the mortgage rate? Exploring 6% Mortgage Rates

A mortgage rate is the interest rate on a home loan. It’s what you pay each month and the total you pay over the life of the loan. Rates vary by economy, lender and borrower’s credit score, how affordable a home is. Simple as that.

Rate of mortgage

The “mortgage rate” is also known as the mortgage interest rate, the percentage of interest on a home loan, how much you pay over the life of the loan. You need to understand this rate if you’re a future homeowner as it affects monthly payments and total cost of the mortgage.

Steps to Understand Mortgage Rates:

- Research Current Rates: Start by looking up the current rates from various lenders. Rates change based on market conditions, loan types and borrower qualifications.

- Determine Loan Type: What type of mortgage are you looking for? Fixed-rate, adjustable-rate, government-backed loans? Each type has different rate and term implications.

- Assess Your Credit Score: Your credit score plays a big role in the rate you qualify for. Higher scores mean lower rates as you’re less of a risk to the lender.

- Evaluate Loan Terms: Decide on the loan term that suits you best, such as 15, 20, or 30 years. Shorter terms typically come with lower rates but higher monthly payments, while longer terms may have higher rates but lower monthly costs.

- Consider Down Payment: A bigger down payment can also get you a better rate. Lenders view a lower loan-to-value ratio as less risky so they can offer better rates.

- Locking in the Rate: Once you find a good rate, consider locking it in with your lender. This way the rate won’t change while you’re going through the mortgage process and you’ll be protected from rate increases.

- Review the Total Cost: Finally, calculate the total cost of the mortgage, including interest, fees, and any additional costs. Understanding the complete financial picture helps you make an informed decision.

By following these steps, you can navigate the complexities of mortgage rates and make a sound financial choice when purchasing a home.

Types of Mortgage Loans

Here are the major types of mortgage loans, broken down into easy steps:

- 1. Fixed-Rate Mortgage:

- What it is: The interest rate remains constant throughout the loan term.

- Why choose it: Predictable monthly payments make budgeting easier.

- Adjustable-Rate Mortgage (ARM):

- What it is: The interest rate starts lower but can change periodically based on market rates.

- Why choose it: Initial lower payments can be appealing, but rates may increase later.

- Government-Backed Loans:

- FHA Loans: Insured by the Federal Housing Administration, these are great for low down payments.

- VA Loans: Available for veterans, these loans often require no down payment and have favorable terms.

- USDA Loans: For rural homebuyers, these loans support low- to moderate-income families with no down payment.

- Jumbo Loans:

- What it is: These loans exceed conforming loan limits and are not backed by government agencies.

- Why choose it: Ideal for purchasing high-value properties, but they typically require stricter credit standards.

By understanding these types, you can choose the mortgage that best fits your financial situation.

Mortgage calculate

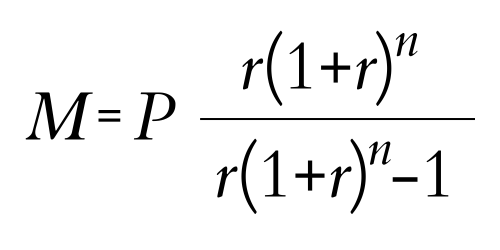

Mortgage calculation helps you determine your monthly payment based on the loan amount, interest rate, and loan term. The formula used is:

Where M is the monthly payment, P is the loan amount, r is the monthly interest rate, and n is the total number of payments.

To easily calculate your mortgage in the USA, you can use Zillow.com. Their mortgage calculator allows you to enter your loan details, providing accurate monthly payment estimates and helping you plan your budget effectively.

Conclusion

In conclusion, a 6% mortgage rates can significantly impact your home financing. It’s important to understand how this rate affects your monthly payments and overall loan cost. Consider your budget, explore different loan options, and shop around for the best rates. Additionally, improving your credit score and making a larger down payment can help secure better terms. Stay informed to make the best decisions for your financial future.